1. It has been brought to our attention that many are unclear as to the role of the Central Bank with regards to the voluntary liquidation as filed by the Progressive Insurance. By way of background, liquidation is the process, formerly known as winding up, by which the business activities of a company are brought to an end. This happens when a company can no longer pay its debts, liabilities or operate its business. Voluntary liquidation is when the actual company files for liquidation, as opposed to a Court order or other factors.

2. In this situation, Progressive Insurance made a special resolution on 9 September 2021 in order to do two things:

(a) Progressive Insurance to be placed into voluntary liquidation; and

(b) Appoint a NZ Resident Liquidator, a Mr. David Ross.

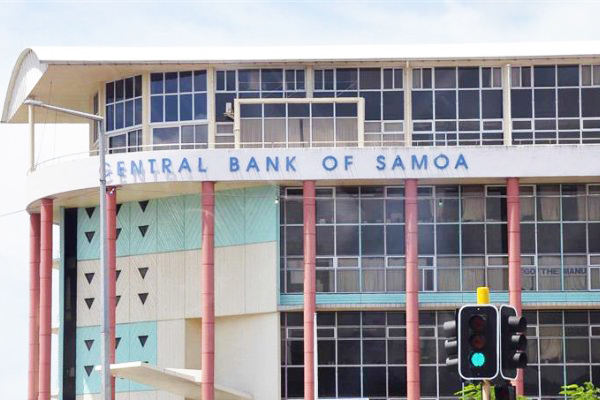

3. Please note that the Central Bank did not lodge or press for a voluntary liquidation, that was the prerogative of the Progressive Insurance. Secondly, Progressive Insurance in its liquidation notice stated that they are unlikely to meet creditors’ claims, given its financial position. It was then prudent for Progressive Insurance to go into a voluntary liquidation.

4. Once the Central Bank received this liquidation notice, it was then the statutory duty of the Central Bank to “cancel” the license. The Central Bank then issued a public notice to this effect on 29 September 2021.

5. When the cancellation notice was issued by the Central Bank on 29 September 2021, it was at this point in time that the legal mandate of the Central Bank to legally supervise Progressive Insurance ceased to exist.

6. The liquidation notice by Progressive Insurance however, falls within the ambit of the Companies Act 2001, which is administered by the Ministry of Commerce, Industry and Labour.

7. If there are any claims or potential claims by the policy holders or creditors, please refer them to the liquidator as appointed by Progressive Insurance, as that is the correct procedure.

8. Should there be any form of complaint(s) as a policy holder, please refer them to Ministry of Commerce Industry and Labour as that would then be a consumer protection matter under their Competition and Consumer Act 2016.

9. It should also be re-noted that the rationale for the voluntary liquidation was because Progressive Insurance could not accommodate or pay out their creditor’s claims given its financial position.